You can write off stock when an item has been lost or stolen, or removed from inventory for other reasons, such as an item that has been given away, offered as a promotion, or used in the store. When you write off stock, the inventory level of the item is updated and the item’s value is handled in your accounting package.

To adjust inventory

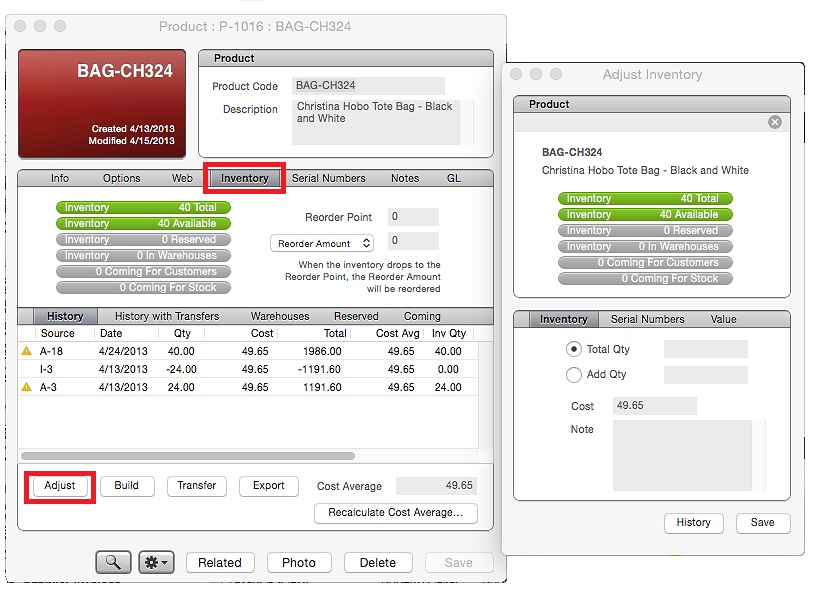

- In OnSite StoreMaster open the product for the item you want to write off and click the Inventory tab.

- Click Adjust.

- Enter the new total quantity in the Total Qty field. Or, select the Add Qty radio button and enter a negative number. For example, to write off one unit of inventory, you add a quantity of −1.

- OnSite populates the Cost field with the item’s default cost. Check the product’s cost average in the inventory tab of the product card before continuing to make sure that items are written off at their current cost average instead of default cost.

- In the Note field type the word writeoff or another word that you use consistently for your write-offs. All of your write-off inventory adjustments must have the same note for you to accurately report on them later.

- Click Save.

To report on write-offs

- In OnSite StoreMaster on the Tools menu click ReportMaster.

- From the Inventory category select the Inventory History report.

- Expand the More Options arrow.

- Set the date range, such as This Month or This Week-to-Date, and the sorting and grouping for the report.

- Under Columns click + and check the Note field. Click + again to close this panel.

- Under Filters, from the first list select Note.

- From the second list select Contains and type writeoff in the text field on the right.

- Run the report.

For more information on running reports and saving customized reports go to Running reports.

To write off and report on serialized items

If you are writing off a serialized item, the steps for removing the item and reporting on it later vary slightly. You may also want to keep a list of written-off serial numbers outside of OnSite.

Writing off a serialized item

- In OnSite StoreMaster open the product for the serialized item you want to write off and click the Inventory tab.

- Click Adjust.

- Find the serial number for the item you are writing off, for example, the serial number of a stolen laptop. It’s important to delete only the serial number you’re writing off.

- Click Delete.

Reporting written-off serialized items

After you delete a serial number run a serial number history report and look for the deletions if you want to report on.

- In OnSite StoreMaster on the Tools menu click ReportMaster.

- From the Inventory category select the Serial Number History report.

- Expand the More Options arrow.

- Set the date range, such as This Month or This Week-to-Date, and the sorting and grouping for the report.

- Under Filters, from the first list select Action.

- From the second list select Is and type Deleted in the text field on the right.

Implications for exporting to QuickBooks or MYOB/AccountEdge

In accounting terms, a write-off is expressed by lowering the value of the inventory account according to the value of the written-off item while absorbing the value of the loss or theft into the cost of goods sold account.

When inventory adjustments are exported to QuickBooks or MYOB/AccountEdge, OnSite uses each product’s inventory and COGS accounts to determine which accounts will be credited and debited.

If you want to track the value of the loss or theft in a separate inventory account rather than the COGS account for this item you can make manual changes in your account package after importing data from OnSite.

For more information on exporting data to QuickBooks or MYOB/AccountEdge go to Exporting individual files to QuickBooks, Batch exporting to QuickBooks and Exporting to MYOB.