Depending on the nature of your business, you may occasionally take products out of inventory for promotions, giveaways, and donations, or you may receive donations from your customers. Through the creation of custom products and payment methods, Lightspeed OnSite can help you record these events so they can be accounted for and reported on.

Accepting Donations

To accept donations from customers, you'll create a product called Donation and add it to any invoice in which a donation is being made.

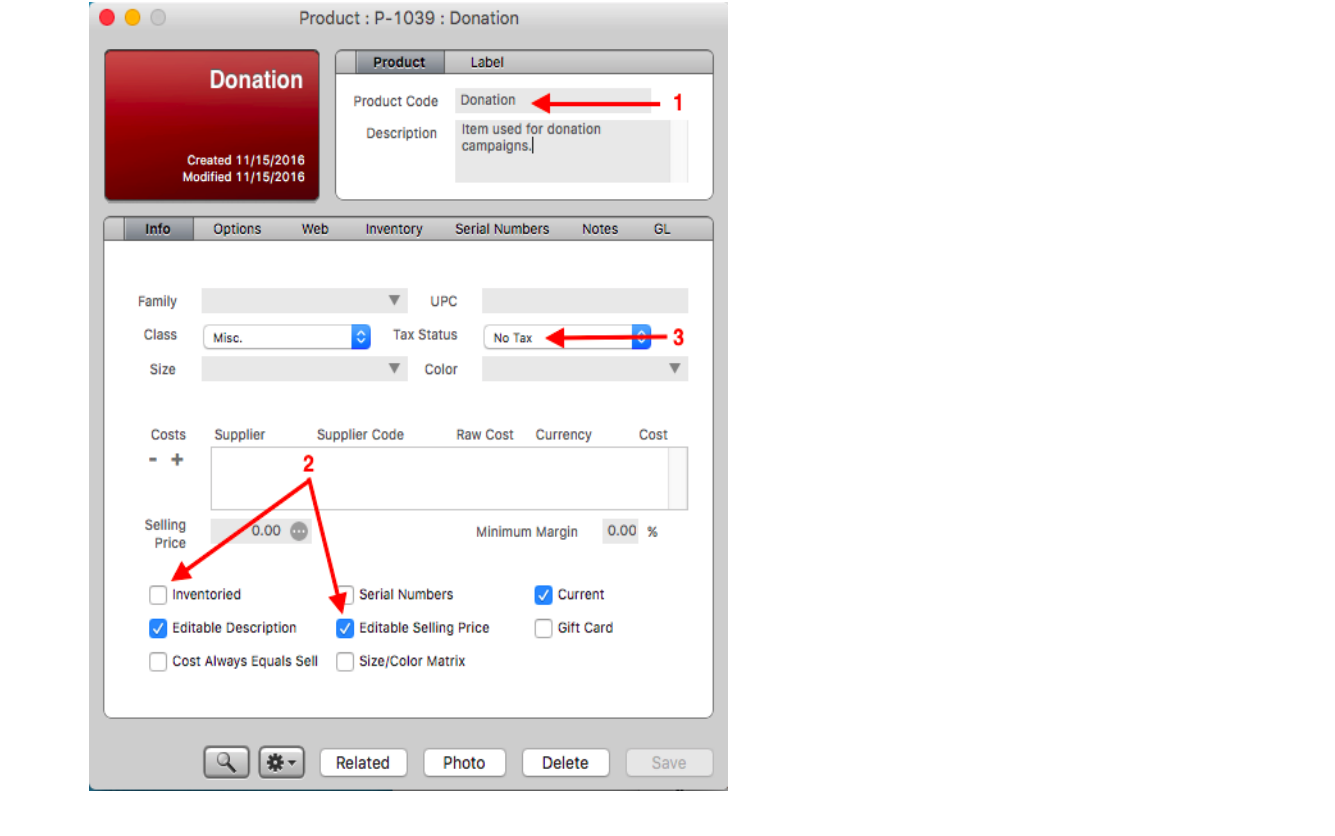

- Create a product called Donation:

- Ensure the Inventoried checkbox is unchecked.

- Ensure the Editable Selling Price checkbox is checked.

- Set the Tax Status to Default or No Tax according to your local tax laws (donations are either taxed and later claimed as a deductible, or not taxed, depending on your location).

- Add this product to the invoice whenever a customer wishes to make a donation.

- Edit the sell price to the amount being donated.

You can run reports on sales by product for Donation to see how much has been collected over a period of time so you can account for it properly in your books.

Donating Products

If you are removing a product from inventory for promotional reasons or as a donation, you'll want to set up an invoice and sell that product using a specific payment method set up for that purpose.

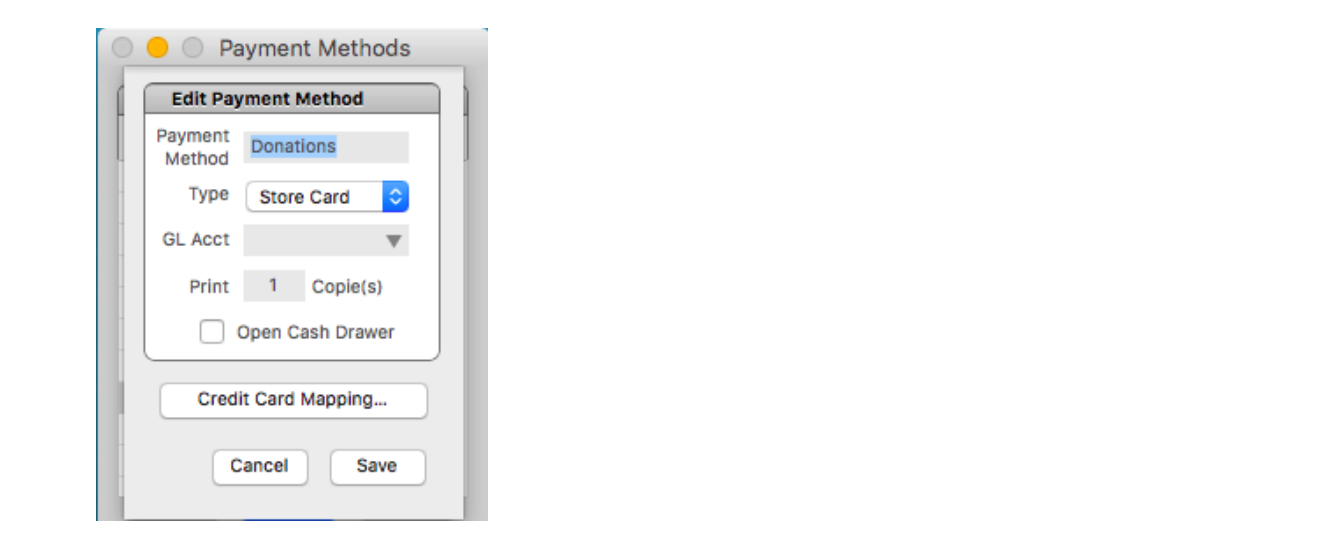

- Navigate to Tools > Setup > Basics > Payment Methods.

- Click New.

- Give the payment method a name, such as Donations, for example.

- Set the Type to Store Card.

- If you have integrated QuickBooks or MYOB, assign this payment method a GL Acct.

- Set the default number of receipt copies to print and whether or not to open the cash drawer when printing.

- Click Save.

You can now create invoices for organization you are donating products to, using them as the customer for that invoice. You'll pay for the products using the new Donations payment method. You can also run reports that target the payment method to keep track of how much you have donated over a period of time.