OnSite can support all of your tax scenarios, including combined taxes, tax-inclusive pricing and tax exemptions.

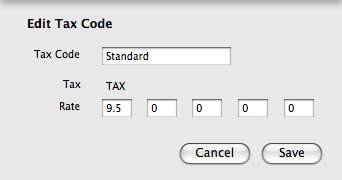

Sales tax

A shoe store in San Francisco applies a sales tax of 9.5% to all its sales.

- In OnSite go to Tools > Setup > Basics > Taxes.

- In the Taxes area rename US Tax to TAX.

- In the Tax Codes area double-click the default tax code, rename it Standard and set the rate of TAX to 9.5.

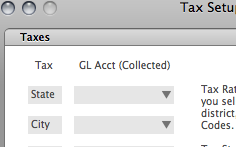

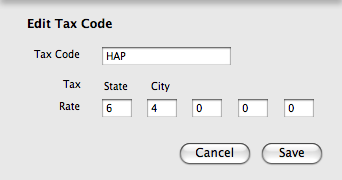

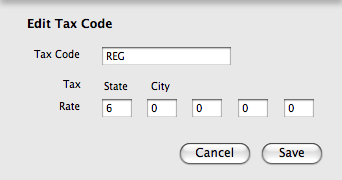

State and city tax

A store in Happy Valley Pennsylvania has a state tax of 6%. There is also a city tax of 4% for sales to residents of Birdsbore, which must be listed separately. If the store sells to anyone else, they need only charge the state tax.

- In OnSite go to Tools > Setup > Basics > Taxes.

- In the Taxes area name two taxes State and City.

- Rename the default tax code HAP and set it to charge a state tax of 6% and city tax of 4%.

- Create the new Tax Code REG that charges a state tax of 6%.

After these changes, a standard sale to residents of Happy Valley defaults to the HAP Tax Code and applies 10% tax, listing each tax separately. However, when a resident of nearby Pleasantville makes a purchase, the tax code can be switched to REG, which charges only 6%.

Changing taxes

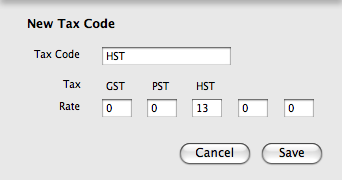

A children's store in Ontario selling clothing, books, and puzzles for children charges 2 taxes: a provincial tax (PST) and a federal tax (GST). Due to a change in the way sales taxes are to be charged, they must change their tax setup to reflect only a new Harmonized Sales Tax (HST). Clothing and books are tax exempt.

- In OnSite go to Tools > Setup > Basics > Taxes.

- In the Taxes area create a new tax called HST. Do not modify or delete existing taxes.

- In the Tax Codes area create a new tax code called HST. Set it to apply a rate of 13% for the HST. Make it the default tax code by dragging it to the top of the list. Do not delete the existing tax codes.

- Set each Sales Station to have HST as the default tax code.

- Modify the No Tax Tax Status to exempt HST only.

- Use Set Product Info to set the tax status of all products with the Classes Clothing and Books to No Tax.

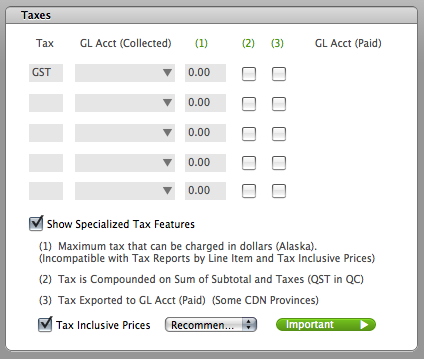

Tax-inclusive pricing

A toy store in Sydney is setting up their database. They use tax-inclusive pricing, and charge one tax called GST.

- In OnSite go to Tools > Setup > Basics > Taxes.

- In the Taxes area create a new tax called GST. Do not modify or delete existing taxes.

- Modify the default tax code to charge the appropriate rate of 10%.

- Select Show Specialized Tax Features > Tax-Inclusive Pricing > Recommended Calculation.

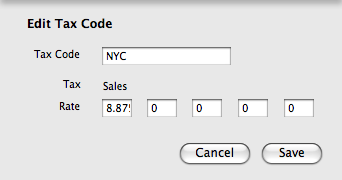

Combined taxes for Multi-Stores

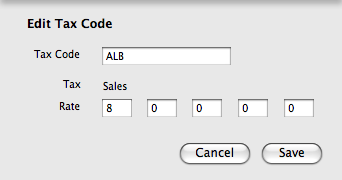

There is a multi-store retailer with locations in New York City and Albany, NY. Taxes in New York state are a combined rate of city, state, and various taxes.

- In OnSite, in each store’s database, name one tax Sales.

- In the New York City location, modify the default tax code to apply a rate of 8.875 for the Sales tax. You have the option of renaming the tax code.

- In the Albany store, modify the default tax code to apply a rate of 8.0 for the Sales tax. You have the option of renaming the tax code.

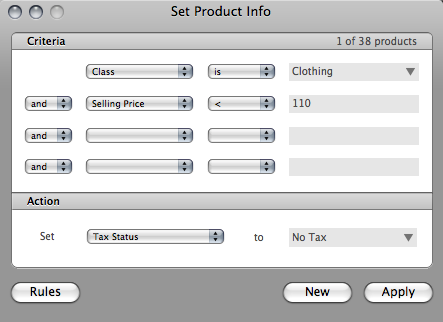

Tax exemption for some items

In New York City, clothing sales under $110 are not subject to sales tax.

Use Set Product Info to set the tax status of all products with the Class Clothing and a selling price of less than $110 to No Tax.