Refunding to a gift card can be useful if you don't offer cash refunds or do not want to track store credits in OnSite.

- Generate a return invoice. If the customer is only returning one or some items from the initial sale, remove them from the return invoice.

- Add a gift card product to the return invoice.

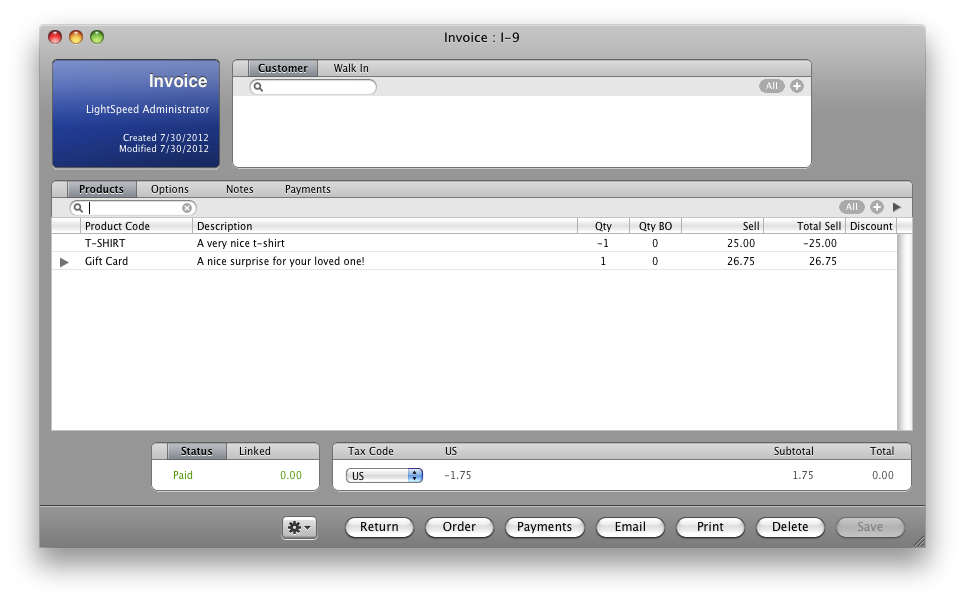

- Modify the selling price of the gift card. If the total to refund is −26.75, make the gift card’s selling price 26.75. Be sure to note any tax that would be calculated on returning products and include that in the selling price of the gift card.

- You will note that the value of the gift card balances out the negative number of the refund (–26.75 + 26.75 = 0.00).

- Proceed to checkout (or, in the Browser, click Save). You will be prompted to activate a gift card serial number.

- The refund total has been balanced by the selling price of the gift card and the Invoice is marked Paid at $0.00.

- Print a receipt and complete the transaction.