Configure OnSite to apply sales taxes to the geographic regions you do business in.

If the sales taxes in your region change, you can make the necessary changes to OnSite Tax to reflect the change. Most changes of this type involve the adjustment of a tax rate.

To prevent accidentally modifying legacy sales documents, we recommended that you create a new default tax code for applying the adjusted rates. Otherwise, modifying an existing tax code can result in legacy sales documents automatically adopting the new rate when they're accessed.

When a new tax is created, we recommend that you create the new tax without modifying an existing one. Then, create a new tax code to apply the proper rates, and make it the default tax code. If you have any questions, contact Lightspeed Support.

If you need to set up tax-inclusive prices go to Setting tax inclusive pricing. This feature is for regions with tax calculations with a requirement for tax-in totals. Do not use this option unless you are in such a region.

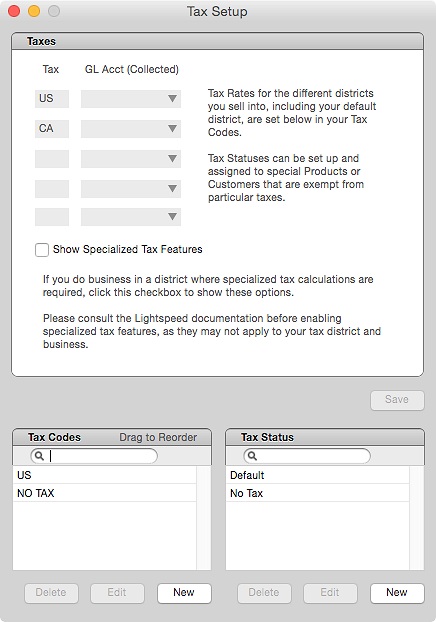

- In OnSite StoreMaster go to Tools > Setup > Basics > Taxes.

- Enter the names of up to five taxes and their general ledger accounts.

- In the Tax Codes area, specify which taxes and which rates are charged in a jurisdiction or circumstance. The default tax code is the one that is used when creating a new sales document. You can create an unlimited number of additional tax codes, for example for charging out-of-state taxes. Tax Codes affect the taxes charged on a per-document basis.

- In the Tax Status area define any tax exemptions. For example, If a customer is entitled to tax exemptions, or a product is exempt from taxes, you can apply the corresponding tax status. Labor can always be exempt from a particular tax. You can create a tax status called Labor Tax Exemption and assign it on the product card of a product that is labor.

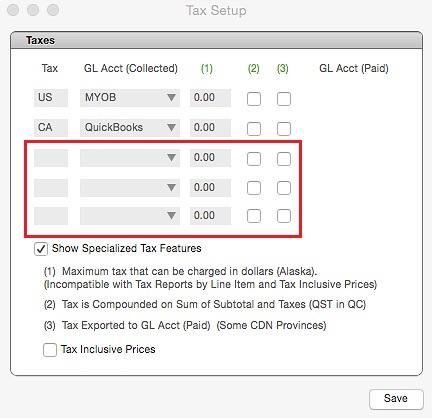

- If you need to configure taxes according local specifications for your tax district and business, select Show Specialized Tax Features. Important: These tax features are specific to a few geographic regions, such as Australia, Alaska, and Quebec, and should not be used unless required. If you aren't sure contact Lightspeed Support.

- In column (1), enter the maximum dollar value for the tax collected. Click checkbox (2) if the tax is compounded on the sum of the subtotal plus the taxes. Click checkbox (3) if a tax is paid and must be assigned a GL account for export to the accounting package.